Managing employees often requires having staff work extra hours, whether beyond an eight-hour workday or a 40-hour workweek. Federal law mandates compensating all non-exempt employees according to overtime rules. It ensures fair pay for the additional time they dedicate to supporting your business.

Overtime regulations vary by state. Hence, it is essential for employers to stay informed about local laws. Employers who willfully or repeatedly violate overtime rules may face civil penalties of up to $1,000 per violation. This underscores the importance of labor law compliance.

Minimum salary requirements for overtime exemption

In April 2024, the U.S. Department of Labor (DOL) introduced a new overtime rule under the Fair Labor Standards Act (FLSA), raising salary thresholds for white-collar exemptions.

The federal government planned to increase the minimum salary for overtime exemptions from $844 per week to $1,128 per week starting January 1, 2025. However, a federal judge in Texas issued a nationwide block on November 15, 2024, preventing the increase from taking effect. This ruling also invalidated the earlier salary increase implemented on July 1, 2024.

As a result, the minimum weekly salary required for overtime exemptions has reverted to $684 per week. The new rules regarding salary overtime will impact many businesses.

State-specific exceptions to overtime pay rules

Many states establish their own salary and duties criteria to determine whether an employee qualifies as exempt from overtime under state regulations. In cases where state laws are more stringent, such as requiring a higher salary threshold or stricter duties tests, employers must comply with state rules.

With the federal minimum salary threshold reverting to $684 per week, six states have set minimum salary requirements for overtime exemptions that surpass the federal standard. The table below outlines these states and their requirements. Be sure to check whether your state’s minimum salary threshold.

As of January 1, 2025, the following states have minimum salary thresholds for overtime exemption that exceed the federal standard of $684 per week. Note that these thresholds apply only to certain exemptions, and employees must also meet the respective state’s duties tests to qualify. For more details, refer to your state’s website.

Alaska

January 1, 2025 – June 30, 2025: $952.80 per week

Starting July 1, 2025: $1,040 per week

California

All regions: $1,320 per week

Colorado

Statewide: $1,086.25 per week

Maine

Statewide: $845.21 per week

New York

New York City, Nassau, Suffolk, and Westchester Counties: $1,237.50 per week

Upstate New York (other regions): $1,161.65 per week

Washington

Employers with 50 or fewer employees: $1,332.80 per week

Employers with more than 50 employees: $1,499.40 per week

Be sure to verify the specific rules and duties tests for your state to ensure compliance with overtime exemption regulations.

How Can You Prepare For Future Overtime Rules Implementation?

Salary overtime disputes can often lead to costly legal challenges for companies. Experts expect the trend of increasing minimum wage and salary thresholds to continue into 2025.

If you are an employer, adopt practices to ensure a smooth transition. Here are some key steps to consider:

- Assess Your Workforce and Classifications: Analyze exempt positions, including job duties and salary structures, to understand the impact of the changes and identify areas requiring adjustment.

- Consult Legal Experts: Work closely with your legal team to interpret the rule’s implications and verify compliance with both federal and state regulations.

- Plan for Implementation: Create strategies for managing potential reclassifications. It should include employee training and clear communication to explain changes in roles and compensation.

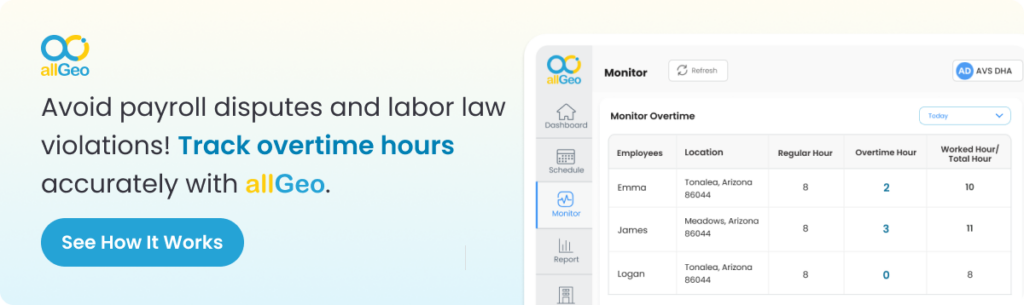

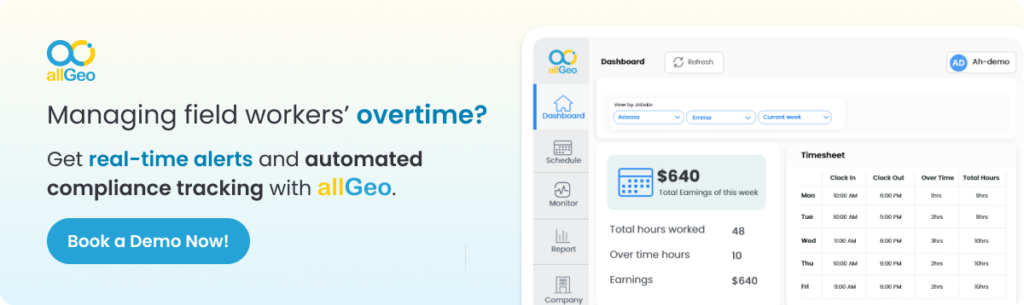

- Track employee work hours: Staying abreast of your employees’ work hours is crucial to ensure compliance. With an advanced time tracking app, you can ease the process for even field employees.

Taking these actions now will help mitigate challenges and ensure your organization is prepared for the upcoming changes.

Which Businesses Are Required to Pay For Overtime Work?

Under the FLSA, businesses are required to pay overtime to non-exempt employees if certain conditions are met. Businesses may fall under Enterprise Coverage if they meet the following criteria:

- They employ at least two workers and have annual revenue of $500,000 or more.

- They operate specific types of facilities, such as hospitals, nursing homes, mental health centers, or educational institutions ranging from preschools to universities.

However, employees do not need to work for a business covered under Enterprise Coverage to be eligible for FLSA protections. Under Individual Coverage, non-exempt employees qualify if their work involves interstate commerce. This can include tasks like sending mail, making interstate phone calls, or handling goods that cross state lines.

Can Employers Refuse to Pay For Overtime?

No, employers covered by the FLSA are required to pay overtime to non-exempt employees for any hours worked beyond 40 in a workweek, regardless of whether the overtime was pre-approved.

Employers can implement policies to prohibit unauthorized overtime. But they must still pay the appropriate overtime rate for all overtime hours worked.

Failing to comply with overtime pay requirements can lead to serious consequences, including liability for back wages, legal fees, and fines. State laws may impose additional penalties, further increasing the risks of non-compliance.

Can Employees Refuse to Work Overtime?

Yes, employees can decline to work overtime. However, in states with “at-will employment” laws, refusing an employer’s request for overtime may result in termination. Exceptions to this rule may apply, depending on the labor laws specific to each state.

Conclusion

Employers must ensure compliance with salary overtime regulations to avoid penalties, especially as rules evolve at both federal and state levels. The reversion of the federal minimum salary threshold to $684 per week, alongside the stricter requirements in several states, highlights the need for employers to remain vigilant in understanding and applying these standards.

To ensure compliance with the overtime rules, businesses should regularly track employee work hours. Further, stay informed to navigate the complexities of overtime rules while maintaining transparency with your teams. Schedule a demo to understand how allGeo can help you in labor law compliance.