Winning a government-funded construction project is exciting, but it also brings extra compliance rules. Two terms you will hear right away are prevailing wage and certified payroll. They sound similar, yet they serve very different purposes. Knowing what they are is critical to staying compliant, protecting workers, and keeping payments flowing on public jobs.

This guide explains what certified payroll is, how it applies to construction projects, and how prevailing wage rates are determined. You will also learn how tools like allGeo can help your team capture accurate time data and generate audit ready certified payroll reports that connect seamlessly with payroll providers.

What Is Certified Payroll?

Certified payroll is a weekly payroll report required on most federal, state, or locally funded construction projects. It verifies that every worker on a covered job site is paid the correct wage and fringe benefits. Contractors and subcontractors must submit this report to the government agency overseeing the project.

The report is typically prepared on Form WH-347 and includes:

- Company name, address, project number, and payroll week ending date

- Each employee’s name and last four digits of their Social Security number

- Job classification or trade

- Straight time and overtime hours worked each day

- Hourly pay rate, gross wages, deductions, and net pay

- A signed statement of compliance certifying the accuracy of the data

The purpose of certified payroll reporting is to protect workers, create transparency, and ensure public funds are spent responsibly.

Certified Payroll in Construction

Certified payroll is most common in construction because these projects often use federal or state money. Highways, bridges, schools, airports, and municipal buildings are typical examples. Even subcontractors must file reports for their own crews if they perform covered work.

What Is a Prevailing Wage?

The prevailing wage is the minimum hourly rate, including fringe benefits, that workers must be paid on a government funded project. The U.S. Department of Labor determines these rates based on location, trade, and current wage surveys. Many states have their own prevailing wage laws and may set rates higher than the federal standard.

Prevailing wage rates ensure fair pay for local workers and prevent contractors from winning bids by undercutting wages. They are often higher than federal or state minimum wages because they reflect real market conditions for skilled trades.

Prevailing Wage vs. Certified Payroll

Although related, prevailing wage and certified payroll are not the same thing.

| Feature | Prevailing Wage | Certified Payroll |

| Purpose | Sets the minimum wage and benefits that must be paid | Provides weekly proof that the correct wages were paid |

| Authority | U.S. Department of Labor or state agency | Federal, state, or local contracting agency |

| Action Required | Pay workers at or above the prevailing wage | Submit Form WH-347 or equivalent each week |

Think of prevailing wage as the rule and certified payroll as the evidence.

Who Must File Certified Payroll Reports?

Certified payroll requirements apply to:

- Prime contractors on federal, state, or local public works projects worth $2,000 or more

- Subcontractors and lower tier subs performing covered work

- Engineering or architectural firms with employees doing on-site construction tasks

Some small maintenance jobs, volunteer work, or projects below the dollar threshold may be exempt. Always check federal and state regulations to confirm.

Certified Payroll Forms and Reporting

To stay compliant:

- Collect time and pay data for every worker each week.

- Verify wage rates against the prevailing wage determination for the project and location.

- Prepare Form WH-347 (or state form) with all required details.

- Sign the compliance statement certifying accuracy and proper payment.

- Submit reports weekly to the contracting agency.

- Retain records for at least three years or longer if state law requires.

Failure to submit accurate certified payroll reports can lead to withheld payments, fines, back wages, or even debarment from future government contracts.

Challenges Contractors Face

Managing certified payroll can be difficult when projects involve:

- Multiple job classifications and wage rates

- Varying overtime rules and shift differentials

- Complex union agreements

- Tight reporting deadlines and detailed recordkeeping

Errors in any of these areas can trigger audits and penalties.

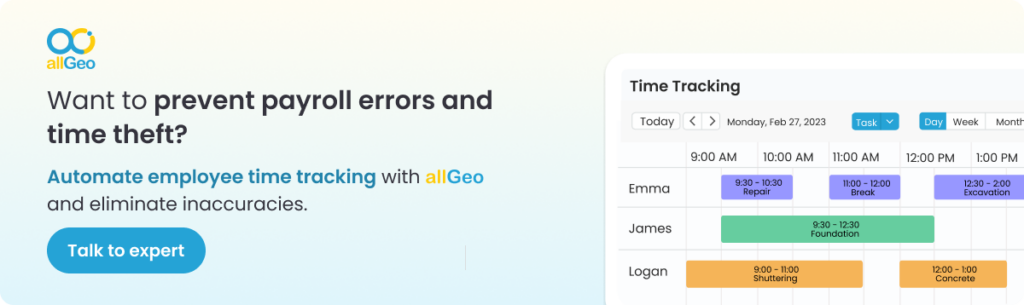

How allGeo Simplifies Prevailing Wage and Certified Payroll Compliance

allGeo is not a payroll processor, but it provides the accurate time and labor data contractors need to generate audit ready certified payroll reports.

GPS-Verified Time Tracking

Workers clock in and out with GPS verification, ensuring accurate hours by job site and trade.

Automatic Wage Coding

The platform assigns the correct prevailing wage codes based on project, location, and trade, creating a reliable audit trail.

Seamless Payroll Integration

allGeo integrates with payroll providers like ADP to export clean data that can be used to create certified payroll reports such as WH-347 without manual entry.

Support for Complex Rules

Handle multiple pay rates, custom overtime rules, shift differentials, and union requirements with ease.

With allGeo, contractors save time, reduce administrative errors, and stay ready for audits while maintaining full compliance with federal and state prevailing wage laws.

Frequently Asked Questions

Is certified payroll the same as prevailing wage?

No. Prevailing wage sets the pay rate. Certified payroll is the weekly report that proves workers were paid at or above that rate.

Who is exempt from certified payroll?

Projects under the $2,000 federal threshold, volunteer work, and some small maintenance jobs may be exempt, but state rules can differ.

What is a certified payroll for prevailing wage?

It is the official weekly payroll record that verifies payment of the prevailing wage and benefits to each worker on a covered project.

What is certified payroll software?

Certified payroll software automates the creation of compliant reports. allGeo captures field data and connects with payroll providers to generate audit ready WH-347 reports.

Key Takeaways

- Prevailing wage sets the pay standard for government funded construction.

- Certified payroll is the proof that the required wages and benefits were paid.

- Compliance is mandatory for contractors and subcontractors on covered projects.

- Accurate time tracking and automated wage coding make compliance easier and reduce risk.

Start Your Free Trial with allGeo

Meeting prevailing wage and certified payroll requirements does not have to be overwhelming. allGeo captures accurate field data, applies the correct wage codes, and integrates with payroll systems to produce audit ready certified payroll reports.

Start your free trial today to simplify compliance, save administrative time, and keep your business ready for every government project.