Keeping up with the latest minimum wage rates across different states can be overwhelming. With so many laws and regulations to consider, the minimum wage in Florida, for instance, can be particularly tricky to navigate.

The current minimum wage in Florida for 2024 is $12 per hour. However, starting September 30, 2024, it will increase to $13 per hour. Additionally, the minimum wage for tipped employees in Florida for 2024 has been raised from $7.98 to $8.98 per hour.

Our blog delves into what is the minimum wage in Florida, the minimum wage for tipped employees and how you can ensure compliance.

Why does the Minimum Wage in Florida Keep Changing?

Florida has been increasing this rate by $1.00 each year on September 30 since 2021. The gradual increase in Florida’s minimum wage began in 2020 after voters approved Amendment 2 to the state’s constitution.

Additionally, Florida voters approved an annual adjustment to the state minimum wage for inflation starting in 2027. The minimum wage will increase by a certain percentage each year on September 30 until 2026.

Under state wage and hour laws, employers must display labor law posters in a visible area to keep employees informed about state and federal minimum wages. Florida employers who fail to display the correct posters are in violation of state minimum wage laws.

What is The Minimum Wage in Florida for Tipped Employees?

- Tipped Employees and Minimum Wage: Tipped employees, like servers, bartenders, and hairdressers, earn most of their income from customer gratuities. Their base hourly wage from employers is often lower than the standard minimum wage because tips are expected to cover the difference.

- Minimum Cash Wage in Florida: In Florida, the minimum cash wage for tipped employees is currently set at $8.98 per hour. This is lower than the minimum wage for non-tipped employees due to the allowance for a tip credit.

- Tip Credit Explained: Employers can claim a tip credit, which reduces the cash wages they must pay, provided the employee’s total earnings (cash wage + tips) meet or exceed the full minimum wage. The current tip credit in Florida is $3.02 per hour.

- Impact of the Tip Credit: If a tipped employee earns enough in tips to bring their total earnings to $12.00 per hour (the current minimum wage), the employer can pay them the base cash wage of $8.98 and claim the remaining $3.02 as a tip credit.

Employers are required to make up the difference if an employee’s total compensation (cash wage + tips) falls short of the minimum wage threshold.

How Can You Ensure Compliance With the Minimum Wage in Florida (or any State) ?

All employers in Florida are required to pay their employees at least the state minimum wage for every hour worked. If an employer fails to meet this requirement, employees have the right to file a civil lawsuit against the employer or any individual violating Florida’s minimum wage law.

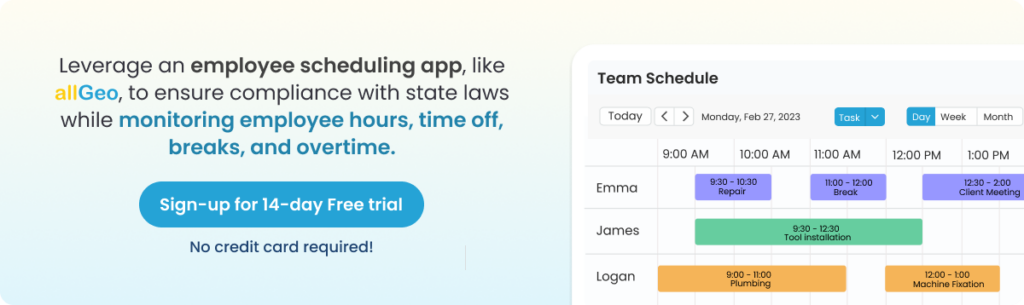

Automate the process

Employees should keep detailed records of their tips and hours worked to ensure they receive the full minimum wage. It becomes easier when you have automated payroll processing with your time tracking, attendance or any other workforce management system.

Since the attendance, overtime, hours worked etc. are stored on the cloud, it acts as a solid proof incase of any legal issues. It also avoids manual errors that may occur in a paper-based system.

Solutions such as allGeo safeguard Protected Health Information (PHI) and Personally Identifiable Information (PII) within a secure environment, employing integrity controls to ensure that electronic PHI (ePHI) remains unaltered and protected from destruction.

Conduct regular audits

Conducting regular audits of payroll practices is essential for spotting and correcting potential field service compliance issues before they turn into legal challenges. These audits easily confirm adherence to minimum wage laws.

Additionally, it also offers a valuable chance to examine employee overtime classifications, verify wage calculations, and assess the validity of any deductions or credits applied. While hiring external experts for these audits can be an added expense, their impartial perspective can reveal issues that internal checks might miss.

Get Legal Advice

US laws are complex. Non-compliance with wage laws can lead to significant penalties, including fines, back wages, and legal complications, with Fair Labor Standards Act (FLSA), fines reaching up to $10,000 per employee per violation. To avoid these costly repercussions, it’s crucial to stay updated on the latest federal and state wage laws and payroll tax requirements, which can be complex and subject to frequent changes.

Is Overtime Pay Mandatory in Florida?

Short answer- yes.

The core principle of Florida’s overtime law is that non-exempt employees who work more than 40 hours in a single workweek must receive overtime pay. This pay must be at least 1.5 times their regular hourly rate for every additional hour worked.

Under the FLSA, overtime is calculated based on the total hours worked within a defined 7-day period, rather than the hours worked in a single day.

However, there is an exception for manual laborers, who are considered a special case in Florida, where daily overtime limits may apply. It is best to read up on the state website for more information.

Conclusion

Navigating complexities of the minimum wage in Florida, or any state, requires enhancing your workflow. The risk of non-compliance can lead to significant financial penalties, legal issues, and a loss of trust among employees. The best way to mitigate these risks is through the automation of payroll processing. Automated solutions ensure accurate record-keeping, minimize human error, and can be updated as per wage laws, making compliance much simpler and more reliable.

By leveraging platforms like allGeo, you can streamline these processes effectively. It offers features like automated time and attendance tracking, real-time GPS tracking for mobile employees, and seamless integration with payroll systems.

This means that every aspect of your workflow that might require payroll processing can be automated with allGeo- from wages, fuel reimbursements, shift differentials etc. It helps ensure that employees are paid accurately and on time, reducing the administrative burden on employers and enhancing overall compliance.

Additionally, allGeo’s customizable workflows and robust reporting capabilities allow for quick audits and easy identification of any potential issues before they escalate.

Investing in automated compliance tools can help your business comply with Florida minimum wage requirements. You can schedule a free demo to know how!