If you’re operating a business in Texas, federal regulations would govern most of the labor law compliance requirements. However, in this blog, we will cover a few of the Texas labor law requirements that is important for field service compliance. If you are a business owner in Texas, here are a few important laws you must be up-to-date with.

Minimum Wage in Texas

Texas has maintained its minimum wage at $7.25 per hour since July 2009.

According to the U.S. Department of Labor (DOL), all employers across the United States, including those in Texas, must pay their workers at least the federal minimum wage, unless specific exemptions apply.

Texas follows the federal minimum wage as outlined in the Texas Minimum Wage Act. It prevents local governments from implementing higher minimum wages for private sector workers.

Texas labor law has some exceptions to its minimum wage requirements, including:

- Workers who are exempt from the Fair Labor Standards Act (FLSA), such as specific salaried professionals, executives, and administrative staff.

- Tipped employees, who can receive a lower minimum wage, potentially as low as $2.13 per hour, provided that their total earnings (including tips) meet or exceed the federal minimum wage.

- Minors and trainees, who may be paid below the minimum wage temporarily under special certificates granted by the DOL.

Workplace Safety and Health in Texas

Texas adheres to federal safety regulations under the Occupational Safety and Health Act (OSHA). Employers in Texas must comply with or exceed OSHA standards to ensure a safe and healthy work environment.

Key Categories of OSHA Requirements

- Administrative Requirements

Employers must have safety manuals and conduct regular safety assessments to align with OSHA standards. - Employee Training

The type of training provided depends on the specific hazards employees may face in the workplace. Training ensures workers are aware of and know how to respond to potential dangers. - Recordkeeping Obligations

Employers must maintain OSHA logs and keep records of safety training sessions. This documentation is critical to compliance and safety audits. - Exposure Testing

Employers should regularly test to ensure employees are not exposed to hazardous conditions, such as high levels of chemicals, noise, or other workplace risks. - Addressing Physical Hazards

Employers must proactively identify and eliminate potential safety hazards in the workplace to minimize risks to employees.

Texas Overtime Laws

According to Texas labor law, non-exempt employees are entitled to receive overtime pay. The rate is1.5 times their regular pay rate for all hours worked over 40 in a standard seven-day workweek, in accordance with the FLSA.

Overtime Exceptions and Exemptions

Texas law exempts certain employees from overtime eligibility, including (but not limited to):

- Piece-Rate Employees: Workers paid on a piece-rate basis.

- Retail or Service Employees: Those in retail or service establishments who earn a regular rate at least 1.5 times the minimum wage and derive more than half of their income from commissions.

- Public Transit Employees: Employees of local electric railways, trolleys, or bus carriers.

- Agricultural Workers: Workers engaged in agricultural activities.

Special Overtime Rules for Nurses

Federal law entitles registered nurses paid hourly to overtime, and hospitals cannot compel nurses to work mandatory overtime. Nurses can choose to decline additional hours. However, these regulations may be waived in the event of a healthcare crisis, such as a contagious disease outbreak. Know more about managing your healthcare staff here.

Conclusion

This guide on Texas labor law aims to provide accurate and relevant information to help businesses and employees stay informed about key regulations. It is crucial to review any linked resources to ensure compliance.

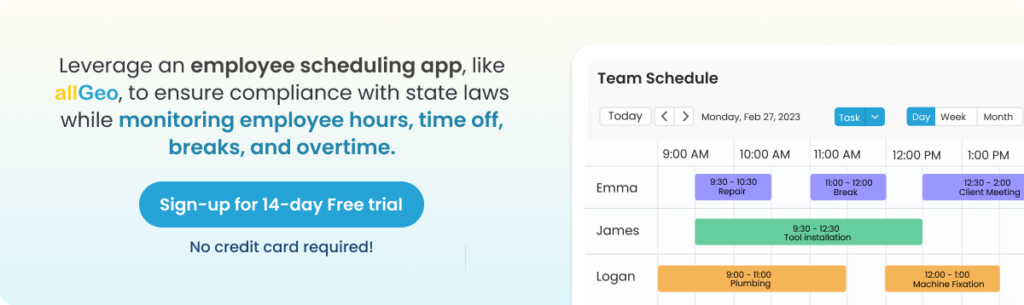

Workforce management apps significantly ease the compliance process. If you are a business owner, or workforce manager, try allGeo for free here!