If you work in construction or manage crews on federally funded projects, chances are you have heard the phrase “Davis-Bacon.” Many builders avoid these projects because field service compliance been a reason to hesitate before bidding on public works projects. The Davis-Bacon Act is one of the most important wage laws in the United States, shaping how contractors pay workers on government-funded jobs.

But learning this law can protect your business and save you from costly fines.

This guide answers the key search questions: What is the Davis Bacon Act, how does it work, and why does compliance matter?

You will also learn how federal agencies set the prevailing wage, how it differs from state wage laws, and how allGeo helps you stay compliant and win more government contracts.

What Is the Davis-Bacon Act? (Davis Bacon Act explained)

The Davis-Bacon Act is a federal law passed in 1931.

It requires contractors and subcontractors on federally funded or federally assisted construction projects worth more than $2,000 to pay workers at least the local prevailing wage.

Lawmakers created it to stop contractors from cutting wages by hiring cheaper labor from other regions.

The U.S. Department of Labor (DOL) enforces the act.

It sets wage rates for each trade and location and updates them through regular surveys.

These rates apply to projects like highways, bridges, schools, housing sites, and other federally funded work.

Davis-Bacon Act Requirements

To comply with the law, contractors must meet specific requirements that go beyond simply paying wages. The key Davis-Bacon Act requirements include:

- Prevailing wage: The DOL sets the prevailing wage rate for each classification and location. Workers must be paid at least that rate.

- Fringe benefits: In addition to cash wages, contractors must provide benefits such as health insurance, retirement contributions, or paid leave, or pay the cash equivalent.

- Certified payroll: Contractors must submit weekly payroll reports (Form WH-347) showing hours worked, classifications, pay rates, and deductions.

- Work classifications: Each worker must be correctly classified by trade or role, and wages must reflect the duties performed.

- Posting requirements: Contractors must display the wage determination at the job site to show workers the rates they are entitled to.

- Overtime rules: For contracts over $100,000, contractors must pay overtime at one and a half times the base rate for hours worked beyond 40 per week, as required by the Contract Work Hours and Safety Standards Act.

Failure to meet these requirements can result in withheld payments, contract termination, fines, and even a ban from bidding on federal projects for up to three years.

Davis-Bacon Act Compliance

Compliance with the Davis-Bacon Act can be complex, especially for small and mid-sized contractors. The challenges include:

- Tracking worker hours accurately across different classifications and projects.

- Managing prevailing wage and fringe benefit calculations.

- Preparing certified payroll reports every week without errors.

- Staying up to date with rule changes, such as the reintroduction of the 30% rule in 2023 or the partial injunction in 2024.

Non-compliance carries significant risks, including repayment of back wages, loss of eligibility for federal projects, reputational damage, and even legal penalties. For contractors, strong systems and processes are essential to avoid mistakes.

What Is a Prevailing Wage? (Davis Bacon prevailing wage)

A prevailing wage is the hourly wage, plus benefits, that contractors must pay workers on public projects. The Department of Labor determines it by surveying local wages paid to workers in similar roles.

The prevailing wage is not the same as the federal minimum wage. While the minimum wage applies broadly to most jobs, the prevailing wage applies only to government-funded construction work and reflects local market rates. This ensures workers are paid fairly for the specific trade or craft they perform in the area where the project is located.

For example, a carpenter in New York City may have a very different prevailing wage than a carpenter in a rural part of Texas. These differences reflect the cost of living, union agreements, and wage standards in each area.

Davis-Bacon vs Prevailing Wage

Contractors often confuse the Davis-Bacon Act with general prevailing wage laws. While related, they are not the same.

- Scope: The Davis-Bacon Act applies only to federally funded construction projects over $2,000. Prevailing wage laws can be state or local and apply to public works projects regardless of federal involvement.

- Wage determination: Under Davis-Bacon, the Department of Labor sets wage rates for federal projects. Under state or local prevailing wage laws, rates are determined by state or municipal labor departments.

- Enforcement: Federal agencies enforce Davis-Bacon, while state or local authorities enforce prevailing wage laws.

In short, Davis-Bacon is a federal law that enforces prevailing wages on specific projects, while prevailing wage laws more broadly cover state and local public works.

Why Davis-Bacon Compliance Matters for Contractors

The Davis-Bacon Act affects how contractors bid on projects, manage payroll, and meet legal obligations.

Critics say it raises construction costs.

Supporters say it protects workers and improves project quality.

Regardless of opinion, compliance is required and failure to comply can put your business at risk.

Key reasons to stay compliant:

- Avoid fines and withheld payments.

- Keep eligibility for government contracts.

- Protect your reputation with workers and agencies.

- Improve accuracy and control when bidding.

How Does allGeo Simplify Davis-Bacon and Prevailing Wage Compliance?

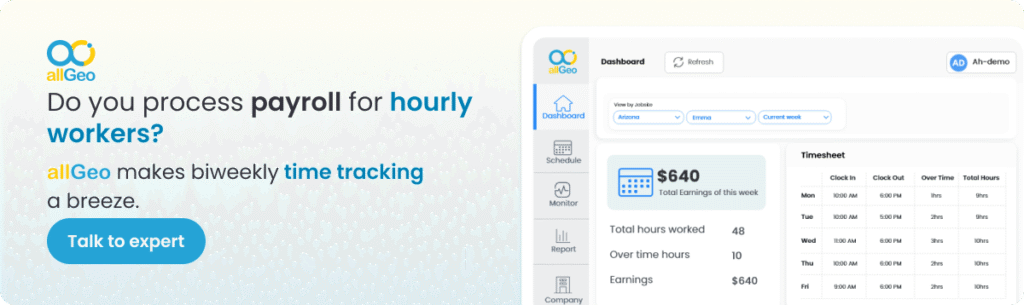

Contractors face many payroll challenges under the Davis-Bacon Act. It includes managing multiple job codes, calculating prevailing wages, handling fringe benefits, and generating certified payroll reports. Manual processes often lead to mistakes, delays, or compliance risks.

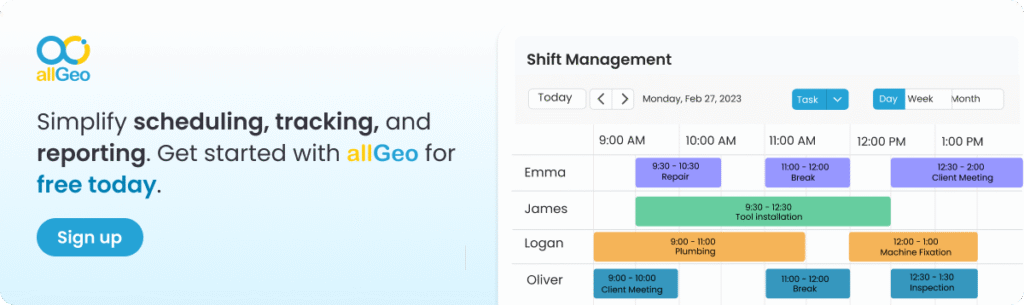

allGeo simplifies compliance by automating your workflow:

- Job Code Setup: Assign job codes once and the system automatically calculates the correct prevailing wage and fringe rate for each worker based on location, shift, and classification.

- Accurate Pay Calculations: Handle multiple pay rates, union fringes, overtime rules, and shift differentials without manual intervention.

- Certified Payroll Reporting: Generate audit-ready payroll reports in seconds, ensuring you meet government requirements every week.

- Real-Time Task Assignment: Dispatch work by job site and shift, with updates pushed instantly to workers. This keeps operations efficient and records precise.

- Seamless Integrations: Connect allGeo with ADP and other payroll systems, scaling your compliance processes across projects while keeping your existing workflows intact.

With enterprise-grade security and automation, allGeo helps contractors eliminate payroll errors, reduce admin work, and stay fully compliant with Davis-Bacon prevailing wage requirements.

👉 Start your free trial today

Conclusion

The Davis-Bacon Act remains one of the most important labor laws for federal construction projects.

It enforces prevailing wage standards, protects workers, and ensures fair competition.

For contractors, understanding Davis-Bacon Act requirements and prevailing wage laws is the key to compliance and eligibility for public projects.

While the law can be complex, the right tools make it easier to manage.

By using allGeo’s automated time tracking and payroll compliance solutions, your business can confidently navigate Davis-Bacon Act compliance, avoid penalties, and win more government contracts.

👉 Start your free trial with allGeo today and simplify Davis-Bacon compliance for your business.

Frequently Asked Questions

1. What is the Davis-Bacon Act?

The Davis-Bacon Act is a federal law passed in 1931 requiring contractors on federally funded construction projects over $2,000 to pay workers no less than the local prevailing wage.

2. What are Davis-Bacon Act requirements?

Key requirements include paying prevailing wages and fringe benefits, submitting weekly certified payroll, classifying workers correctly, posting wage determinations on site, and complying with overtime rules on contracts over $100,000.

3. What is a Davis-Bacon prevailing wage?

A Davis-Bacon prevailing wage is the hourly pay plus benefits set by the Department of Labor for specific trades in a local area. It ensures workers on federal projects are paid fairly.

4. What is the difference between Davis-Bacon and prevailing wage?

The Davis-Bacon Act is a federal law that enforces prevailing wages on federal projects. Prevailing wage laws are broader state or local laws that apply to public works projects regardless of federal funding.

5. How can contractors stay compliant with the Davis-Bacon Act?

Contractors must track worker hours, calculate prevailing wages, provide fringe benefits, and submit certified payroll reports. Using workforce management tools like allGeo simplifies compliance.