Two widely used payroll schedules are the semi-monthly and biweekly payroll schedules. However, a common area of uncertainty are the differences between semi-monthly and bi-weekly payroll. Whether you’re a business owner or an employee, understanding the distinction between them is crucial. It affects employee satisfaction as well as budgeting.

At first glance, these schedules may appear similar, with both typically spanning about four weeks. However, they function quite differently. The choice of payroll frequency—whether semi-monthly, bi-weekly, or even bi-monthly— influences cash flow, budgeting, and employee morale.

We will dive into both to understand which one is suitable for your business.

What is Semi-Monthly Payroll?

In a semi-monthly payroll schedule, employees receive two paychecks each month—one mid-month and the other at the end or beginning of the next month. Typically, employees are paid on fixed dates such as the 1st and 15th, or the 15th and last day of the month.

With this schedule, employees get 24 paychecks annually. Since not all months have the same number of days, paycheck amounts can vary. For instance, the second paycheck in February might cover only 13 or 14 days. Salaried employees may not notice this variation, as their total annual salary is usually evenly divided across 24 checks.

Pros of Semi-Monthly Payroll

- Ideal for salaried employees: This schedule works particularly well for salaried employees. Their annual salary can be easily divided into consistent pay amounts.

- Easier budgeting for employees: The fixed payment dates help employees manage their personal expenses more effectively.

- Simplified payroll tracking: Employers benefit from easier payroll management, especially when calculating benefit deductions, as deductions occur twice monthly.

Cons of Semi-Monthly Payroll

- Perceived inconsistency: Employees may feel the pay schedule is less consistent since payday can fall on different days of the week each month.

- Weekend payday challenges: If payday lands on a weekend, employers need to decide whether to process payroll on the preceding Friday or the following Monday, as banks typically don’t process payments on weekends.

What is Biweekly Payroll?

In the biweekly payroll schedule, employees are paid every other week. It results in a total of 26 paychecks per year. This is one of the most commonly used payroll schedules in the U.S. due to its flexibility and balance for different types of workers.

For example, an employee might receive their paycheck every second Thursday. Since there are 52 weeks in a year (and sometimes 53 in a leap year), this schedule offers 26 paychecks annually, or occasionally 27, depending on the payroll cycle. While employees receive pay more frequently, the individual paycheck amounts are generally smaller than those of a semi-monthly schedule.

Pros of Biweekly Payroll

- Consistent paydays: Employers pay employees on the same day every two weeks. It creates a predictable schedule that helps with budgeting

- Two additional paychecks: Biweekly payroll gives employees two extra paychecks per year compared to semi-monthly payroll.

- Ideal for hourly workers: Biweekly payroll makes it easier to calculate and track overtime for hourly employees, aligning well with fluctuating work hours.

Cons of Biweekly Payroll

- Budgeting challenges for employers: While extra paychecks may be beneficial for employees, employers must plan carefully to manage cash flow, especially during months with three payroll cycles.

- Smaller paycheck amounts: Although biweekly payroll results in more frequent payments, each paycheck is generally smaller than what employees would receive under a semi-monthly schedule.

Which Payroll Schedule Works Best For you?

Deciding whether a semi-monthly or biweekly payroll schedule is best for your business depends on a variety of factors. Before processing payroll, it’s important to evaluate the following key aspects:

- Payroll compliance: Some states have specific laws that dictate how frequently employees must be paid. Your payroll schedule must comply with federal regulations, such as the Fair Labor Standards Act (FLSA) too to ensure compliance.

- Frequency & Consistency: Employees may find it difficult to manage their finances with the varying paydays of a semi-monthly schedule. It’s essential to consider whether the consistency of biweekly payments would be better suited to your employees’ financial planning and help reduce potential stress.

- Financial Planning: If tasks like cash flow management and budgeting are challenging for your company or HR team, it might be worth exploring a different payroll frequency. Choosing a schedule that better aligns with your company’s financial rhythms can streamline processes and ease the burden on your payroll team

- Tracking solutions: No matter which schedule you opt for, you need to track your employees’ time or work progress to process the payroll. Gone are the days of written logs. Hence, payroll automation is one way to make the payroll schedule easier for you.

Payroll automation offers significant benefits for both employees and employers by:

- Streamlining administrative tasks: Automation reduces the time and effort spent on manual payroll processes.

- Supporting employee financial management: Regular, automated payments help employees manage their finances and budget more effectively.

- Enhancing business cash flow: Automation ensures timely payments, helping businesses maintain better control over cash flow.

- Reducing errors in payroll: By minimizing manual data entry, automation lowers the risk of mistakes in payroll calculations.

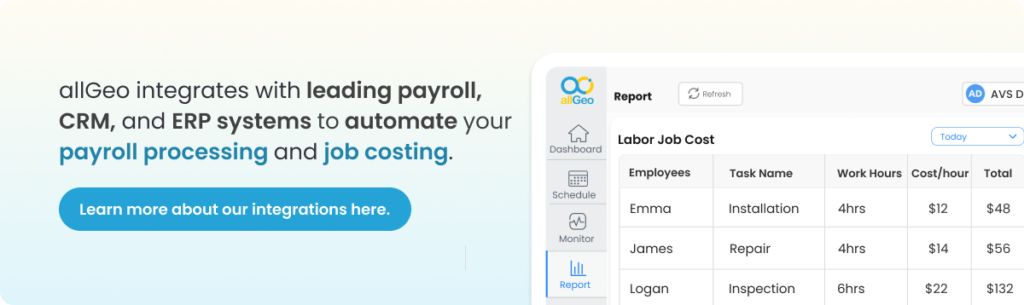

- Third-Party Payroll Integration: A workforce management system that integrates with third-party payroll platforms can simplify the payroll process. It enables smooth data transfer between systems, removing the need for manual entry and minimizing the potential for errors. This type of integration is crucial for businesses with diverse workforces or complicated pay structures.

Conclusion

Adopting a payroll schedule depends entirely on your unique business needs. Semi-monthly payments offer predictable schedules that simplify budgeting. Similarly, bi-weekly payments provide more frequent payouts, helping with cash flow and saving potential. The right payroll cycle depends on your business’s specific needs and the preferences of your workforce.

If you’re in search of workforce management software that can track shift differentials and even dynamic pay rates, allGeo is a trusted solution. Sign up for a free trial to help you understand its various benefits.